Absolutely Yes, Getting an Axis Bank Credit Card with a salary of ₹15,000 is Possible. When it comes to credit cards, Axis Bank is a renowned name in the banking industry due to its attractive features and benefits. In this article, we will explore the eligibility criteria, documents needed, and other important factors to consider when applying for an Axis Bank credit card with 15000 Salary. ( We also Recommend 3 Option For You 😉 )

Eligibility Criteria for Axis Bank Credit Card:

To be eligible for an Axis Bank credit card, you need to meet certain criteria. These criteria may vary based on the specific credit card you are applying for. However, here are some general eligibility requirements:

- Age: The primary cardholder should be at least 18 years old. Some credit cards may have a higher age requirement.

- Income: While a minimum salary requirement is not explicitly mentioned by Axis Bank, a higher income may increase your chances of getting approved for a credit card.

- Credit Score: A good credit score demonstrates your creditworthiness and can positively impact your chances of getting a credit card.

- Employment: Stability in employment or business can be a contributing factor in the approval process.

Documents Required for Axis Bank Credit Card:

To apply for an Axis Bank credit card, you will typically need to provide the following documents:

- Proof of Identity: Aadhaar Card, Passport, Voter ID, or any other government-issued photo ID.

- Proof of Address: Aadhaar Card, Passport, Utility Bill, or any other valid address proof.

- Proof of Income: Salary slips, bank statements, IT returns, or Form 16.

- Photographs: Passport-sized

- Application form: Completely filled

Ensure that you have all the necessary documents ready before applying for an Axis Bank credit card.

Factors That May Influence Approval:

Apart from meeting the eligibility criteria and providing the required documents, several other factors may influence the approval of your Axis Bank credit card application. Let’s take a look at them:

- Credit History: A good credit history reflects responsible credit behavior and increases your chances of approval.

- Debt-to-Income Ratio: This ratio compares your monthly debt obligations to your income. A lower ratio suggests better financial stability and may improve your chances of getting a credit card.

- Existing Relationship with Axis Bank: Having an existing savings or salary account with Axis Bank can work in your favor during the credit card application process.

- Employment Type: Your employment type, whether salaried or self-employed, can impact the decision-making process.

Axis Bank Credit Cards Recommendations :

Certainly! Here are the recommendations for three Axis Bank credit cards along with their features, eligibility & applying details:

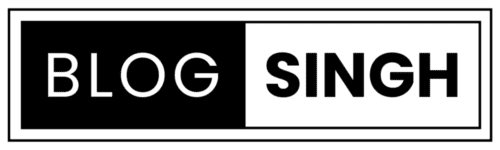

(1.) Axis Bank Flipkart Credit Card:

The Axis Bank Flipkart Credit Card is a co-branded card designed for frequent shoppers on Flipkart. It offers exclusive benefits and rewards for online shopping enthusiasts. Some key features of this card include

Features :

- Welcome Benefits: Get a Flipkart voucher as a welcome gift on your first transaction.

- Reward Points: Earn 4 reward points for every ₹200 spent on Flipkart and 1.5 points on other categories.

- Flipkart Plus Membership: Enjoy complimentary Flipkart Plus membership, offering free delivery and other exclusive perks.

- Fuel Surcharge Waiver: Avail of a 1% fuel surcharge waiver on fuel transactions.

- Joining and Annual Fee: The joining fee is ₹500, and the annual fee is ₹500.

Eligibility:

- Age: The primary cardholder should be between 18 and 70 years of age.

- Income: The minimum monthly income requirement is ₹15,000.

[ Apply Link : Apply for Axis Bank Flipkart Credit Card ]

(2.) Axis Bank My Zone Credit Card:

The Axis Bank My Zone Credit Card is tailored for individuals who enjoy shopping and dining out. It provides attractive cashback and discounts on various categories. Here are its key features:

Features:

- Dining and Shopping Benefits: Earn 4-40% cashback on dining, shopping, and entertainment transactions, based on the merchant category.

- Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver on fuel transactions.

- Milestone Rewards: Get annual eDGE Loyalty Rewards points based on your spending milestones.

- Contactless Payments: Enjoy the convenience of contactless payments for quick and secure transactions.

- Joining and Annual Fee: The joining fee is ₹500, and the annual fee is ₹500.

Eligibility:

- Age: The primary cardholder should be between 18 and 70 years of age.

- Income: The minimum monthly income requirement is ₹15,000.

[ Apply Link : Apply for Axis Bank My Zone Credit Card ]

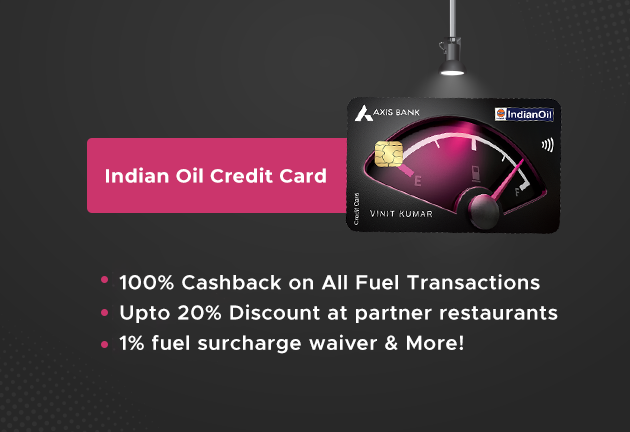

(3.) Axis Bank Indian Oil Credit Card:

Features:

- Fuel Benefits: Earn up to 4% fuel surcharge waiver on fuel transactions at Indian Oil outlets.

- Rewards: Earn accelerated eDGE Loyalty Reward points on dining, shopping, and fuel transactions.

- Annual Fee Reversal: Get your annual fee reversed on spending a certain amount on the card within a year.

- Contactless Payments: Enjoy the convenience of contactless payments for quick and secure transactions.

- Joining and Annual Fee: The joining fee is ₹500, and the annual fee is ₹500.

Eligibility:

- Age: The primary cardholder should be between 18 and 70 years of age.

- Income: The minimum monthly income requirement is ₹15,000.

[ Apply Link : Apply for Axis Bank Indian Oil Credit Card ]

Frequently Asked Questions (FAQs):

Q1: Is it possible to get an Axis Bank Credit Card with 15000 salary ?

Yes, it is possible to get an Axis Bank credit card with a salary of ₹15,000. However, meeting the eligibility criteria and providing the necessary documents is crucial for a successful application.

Q2: Will a higher income increase my chances of getting an Axis Bank credit card?

Having a higher income can potentially increase your chances of getting approved for an Axis Bank credit card. However, it is not the sole factor considered during the evaluation process.

Q3: What if I have a low credit score? Can I still get an Axis Bank credit card?

While a low credit score may make it more challenging to obtain a credit card, it is not impossible. Axis Bank evaluates various factors, including your credit score, while assessing your application.

Q4: How long does it take to get an Axis Bank credit card approved?

The approval process for an Axis Bank credit card usually takes around 7 to 15 working days, provided all the required documents and information are submitted accurately.

Q5: Can I apply for an Axis Bank credit card online?

Yes, Axis Bank offers online credit card application facilities. You can visit their official website or use their mobile app to apply for a credit card conveniently.

Q6: Are there any annual fees or charges for Axis Bank credit cards?

Yes, most Axis Bank credit cards have annual fees and other charges associated with them. The specific fees and charges depend on the type of credit card you choose.

Conclusion:

Obtaining an Axis Bank credit card with a salary of 15000 is possible, provided you meet the eligibility criteria, provide the necessary documents, and maintain a good credit history. It is essential to assess your financial situation and choose a credit card that aligns with your needs and repayment capabilities. Remember to read and understand the terms and conditions associated with the credit card before applying.

Whether you’re looking for rewards, cashback, or other exclusive benefits, Axis Bank offers a range of credit cards to suit various needs. So, if you meet the eligibility requirements, don’t hesitate to apply for an Axis Bank credit card and enjoy the perks it offers.